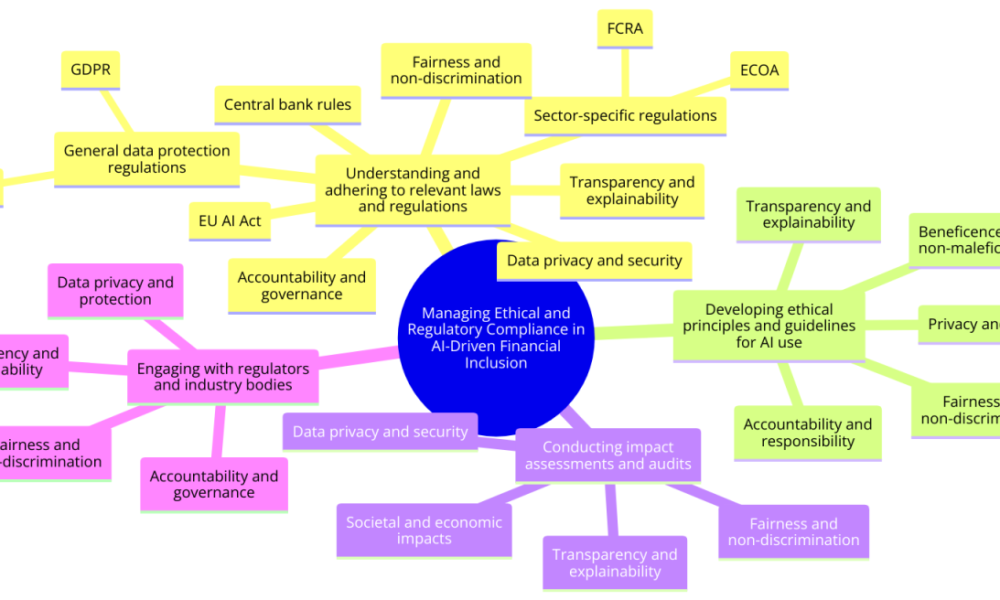

Regulatory Compliance and Financial Inclusion

In today’s financial landscape, regulatory compliance and financial inclusion are two critical aspects that need to be addressed. While regulatory compliance ensures the stability and integrity of the financial system, financial inclusion aims to provide access to financial services for underserved populations. At Finaskills Consult, we believe in finding a balance between these two objectives, leveraging innovative strategies and technology to create a more inclusive and compliant financial ecosystem.

Understanding Regulatory Compliance:

Regulatory compliance forms the foundation of a well-functioning financial industry. It ensures that financial institutions operate within the legal framework, mitigating risks and preventing financial crimes. Our team at Finaskills Consult is well-versed in the regulatory landscape, staying up-to-date with the latest guidelines and requirements. We work closely with financial institutions to develop compliance solutions, assisting in the design and implementation of robust frameworks, policies, and procedures.

Promoting Financial Inclusion:

Financial inclusion is about extending access to financial services to individuals and communities that have been traditionally excluded. At Finaskills Consult, we recognize the importance of promoting financial inclusion to drive economic growth and reduce inequality. We actively support initiatives that foster financial access for underserved populations. By collaborating with financial institutions, we help develop innovative products and services, such as inclusive lending programs, microfinance solutions, and digital banking platforms.

Leveraging Technology for Inclusion:

Technology plays a pivotal role in advancing financial inclusion while maintaining regulatory compliance. At Finaskills Consult, we assist financial institutions in leveraging technology to expand their reach and provide cost-effective financial services. Digital banking platforms, mobile payment systems, and alternative credit scoring models are just a few examples of how technology can bridge the gap between regulatory requirements and financial inclusion goals. By embracing technological advancements, we can create a more inclusive and accessible financial ecosystem.

Collaboration and Advocacy:

Achieving a balance between regulatory compliance and financial inclusion requires collaboration and advocacy. At Finaskills Consult, we actively engage with regulatory bodies, policymakers, and industry stakeholders to advocate for policies and regulations that support both objectives. By participating in dialogues and highlighting the importance of striking a balance, we can influence policy decisions that foster a more inclusive financial system. Together, we can build a sustainable financial ecosystem that addresses the needs of all stakeholders.

Conclusion:

Striking a balance between regulatory compliance and financial inclusion is crucial for a sustainable financial ecosystem. At Finaskills Consult, we believe in achieving this balance by providing compliance solutions, leveraging technology, and advocating for inclusive policies. By working together, financial institutions, regulatory bodies, and industry stakeholders can create an environment that not only ensures compliance but also extends access to financial services for underserved populations. Trust Finaskills Consult to be your partner in driving regulatory compliance while promoting financial inclusion for a more equitable future.